What to Include in Your Life Insurance. Downloadable Checklist.

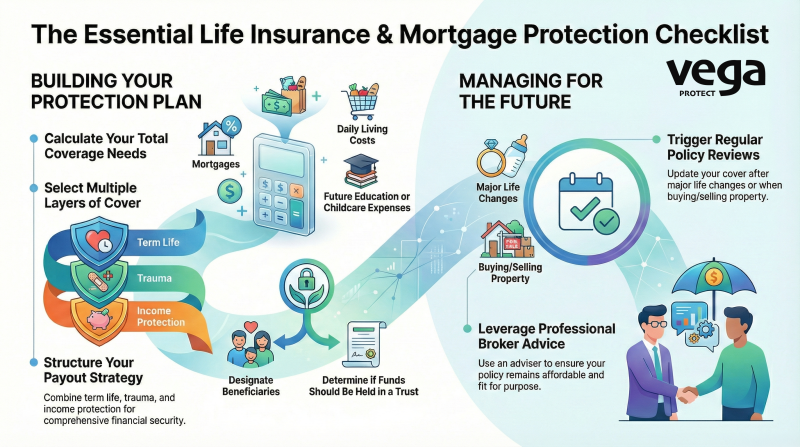

Life insurance plays an important role in protecting your family, your home, and the plans you’re working towards. Yet for many New Zealanders, setting up or reviewing an insurance policy can feel overwhelming and becomes a ‘to-do’ that is quickly bumped down the list.

How much cover is enough? What type do you need? And how do you make sure it’s right for your situation?

A life insurance checklist cuts through the uncertainty. It prompts you to think about what aspects of a policy are most important to you, consider your risks, and confidently put the right protection in place.

Download the Life Insurance Checklist (PDF)

1. Coverage Amounts to Consider

You’d be surprised at how many clients who come to us either under- or over-insured. So, one of the first questions anyone should ask before taking out a policy is how much cover you actually need.

Different life stages come with different responsibilities. Buying your first home, starting a family, or running your own business all change the type and level of cover you need. As you can imagine, the right amount isn’t one-size-fits-all figure, it’s incredibly personal and will change over your lifetime.

2. Types of Life Insurance to IncludeOnce you know what you need to protect, the next step is choosing the right mix of cover. In New Zealand, life insurance is often structured using several policy types to respond to specific risks.

Life insurance is one of the most popular policies and provides a lump sum payment if you pass away during the policy term. It’s usually used to protect a home loan or provide financial security for your family.

Trauma or critical illness cover pays out if you’re diagnosed with a serious medical condition. It can help cover treatment costs and reduce financial pressure while you’re recovering.

Income protection replaces a portion of your income if illness or injury stops you from working. This is particularly important for self-employed people, as you don’t have sick leave or employer support to fall back on.

3. Beneficiaries and Policy Structure

Choosing who receives the benefit can be just as important a decision as the policy itself. How the policy is structured can affect how quickly funds are accessed and how they’re used, particularly when children are involved. It’s worth getting professional advice before making this choice by speaking to an insurance partner, like Vega Protect.

4. Regular Reviews and Updates

Life insurance isn’t ‘set and forget’. Buying a home, starting a family, changing careers, or growing a business are all good reasons to review your cover. A regular check-in with an adviser helps to ensure your policy still matches your circumstances.

5. How an Adviser Can Help

Working with an insurance adviser helps you look at the bigger picture and ensure your life insurance cover is practical, affordable, and suited to your circumstances. An adviser takes the time to understand your income, family responsibilities, health considerations, and long-term goals, then recommends insurance solutions that provide the right level of protection without unnecessary complexity.

Choose Vega Protect for Life Insurance NZ

Creating a life insurance checklist is a great place to start, but professional advice can take that information and make sure you’re getting the best possible policy for your circumstances. If you’d like guidance on selecting the right life insurance and mortgage protection, contact Vega and speak to our advisers today.