How Much Can You Save by Refinancing Your Home Loan?

Refinancing your home loan can be a powerful financial move, but what does it really mean? At its core, refinancing involves replacing your current mortgage with a new one, often with different terms. Homeowners typically pursue refinancing to secure a lower interest rate, reduce monthly payments, or change the loan term. But how much can you actually save by making this switch? Let’s dive into the potential benefits and savings associated with refinancing your home loan.

Introduction to Refinancing

Refinancing can open up a world of financial advantages. The most common reasons homeowners choose to refinance include:

- Lower Interest Rates: A drop in interest rates can lead to substantial savings over the life of your loan.

- Reduced Monthly Payments: By securing a lower rate or extending your loan term, you can lower your monthly expenses.

- Shorter Loan Terms: Refinancing to a shorter term can help you pay off your mortgage faster and save on interest overall.

Understanding how these factors interact can help you make an informed decision about whether refinancing is right for you.

Read more about refinancing your mortgage.

Factors Affecting Savings

Interest Rate Reduction

One of the most significant factors affecting your savings is the interest rate reduction. Even a small decrease in interest rates can lead to considerable long-term savings. For example, if you refinance from a 4% interest rate to a 3% rate on a $300,000 loan, you could save thousands over the life of the loan.

Loan Term Adjustments

Adjusting your loan term can also impact your savings. Shortening your term, say from 30 years to 25 years, can mean higher monthly payments but significantly less interest paid over time. Conversely, extending your loan term can lower your monthly payments, but it may lead to higher total interest costs.

Switching Interest Rates

When refinancing, you can choose between fixed and variable interest rates. A fixed rate offers stability and predictability, while a variable rate can provide lower initial costs but may fluctuate over time. Understanding the implications of each option is crucial for assessing potential savings.

Lenders' Fees and Refinancing Costs

Before jumping into refinancing, it's essential to account for closing costs and other fees associated with the process. These costs can eat into your savings, so calculating your net savings after fees is vital. Typical closing costs can range from 2% to 5% of the loan amount, which can affect the overall benefits of refinancing.

Example Scenarios

Let’s take a look at some example scenarios to illustrate potential savings.

Scenario 1: Lowering the Interest Rate

Consider a homeowner with a $300,000 mortgage at a 4% interest rate who refinances to a 3% rate. Over a 30-year term, this could lead to savings of approximately $50,000 in interest payments.

Scenario 2: Shortening the Loan Term

Now, let’s say the same homeowner opts to refinance to a 25-year term at a 3.5% interest rate. Their monthly payment may increase slightly, but the total interest paid could be significantly lower – potentially saving them over $30,000 compared to the original loan.

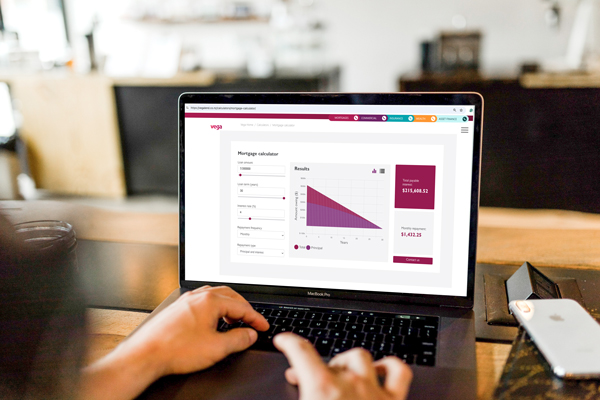

Using mortgage calculators can help you visualise these scenarios and see the potential savings over different periods.

When Refinancing Makes Sense

Knowing when to refinance is crucial. Indicators that it might be a good time include:

- Market Interest Rates Have Dropped: If rates have decreased since you took out your original loan, refinancing may be beneficial.

- Improved Credit Score: A higher credit score can qualify you for better rates.

- Need to Consolidate Debt: Refinancing can also be an option if you want to consolidate higher-interest debt into your mortgage.

Assessing whether refinancing is worth it depends on your individual circumstances, including your financial goals and market conditions.

How to Calculate Your Savings

Calculating potential savings from refinancing is straightforward. Start by determining your current loan balance, interest rate, and remaining term. Then, estimate your new loan's terms. Use the following steps:

- Compare Interest Rates: Find your current and potential new rates.

- Estimate Monthly Payments: Use a mortgage calculator to determine new monthly payments.

- Calculate Total Interest: Assess how much interest you’ll pay over the life of the loan.

- Subtract Closing Costs: Factor in any closing costs associated with refinancing.

Mortgage refinance calculators are excellent tools to help you estimate savings quickly and easily.

Additional Considerations

While refinancing can offer savings, it’s essential to think about the overall impact on your financial health. Shop around for the best deals, as different lenders may offer varying rates and terms. Additionally, consider the balance between long-term and short-term savings – sometimes a smaller immediate reduction in monthly payments might lead to significantly higher total interest paid over the loan’s life.

In conclusion, refinancing your home loan can provide substantial savings, but it’s essential to evaluate your specific situation. By considering interest rates, loan terms, and associated costs, you can make a more informed decision about whether refinancing is the right move for you. With the right planning and calculation, you could save a considerable amount of money, making homeownership more affordable in the long run.

Want to learn more about refinancing your home loan? Watch this fun, easy to understand video and then reach out to us today. Our friendly, knowledgeable team will be back in touch shortly to talk you through your options.